- December 30, 2024

The 1099 Form is a series of tax-related forms in the United States that are categorized as a series of information returns Forms by the Internal Revenue Service. There are many different types of 1099 Forms for different payments that the taxpayer receives from a non-employment income.

An independent contractor 1099 Form is issued to an independent contractor or a freelance worker who earns more than $600 as non-employment income. This is known as the 1099-NEC and needs to be reported on the tax return. If the taxpayer receives unemployment benefits, the taxpayer will receive a 1099-G Form, which the taxpayer needs to report on the tax return.

The 1099 tax Form for independent contractors includes a social security number or a TIN to help the IRS know that the taxpayer has received money. Thus, it can be easily identified if the taxpayer has not reported the income on their tax return. Independent contractors or freelancers who work with companies receive the 1099-NEC. Companies must send a 1099-NEC to all the contractors who worked for them but not as regular employees of the company.

Table of Contents

A Step-by-Step Guide to Filling Out the 1099-Form

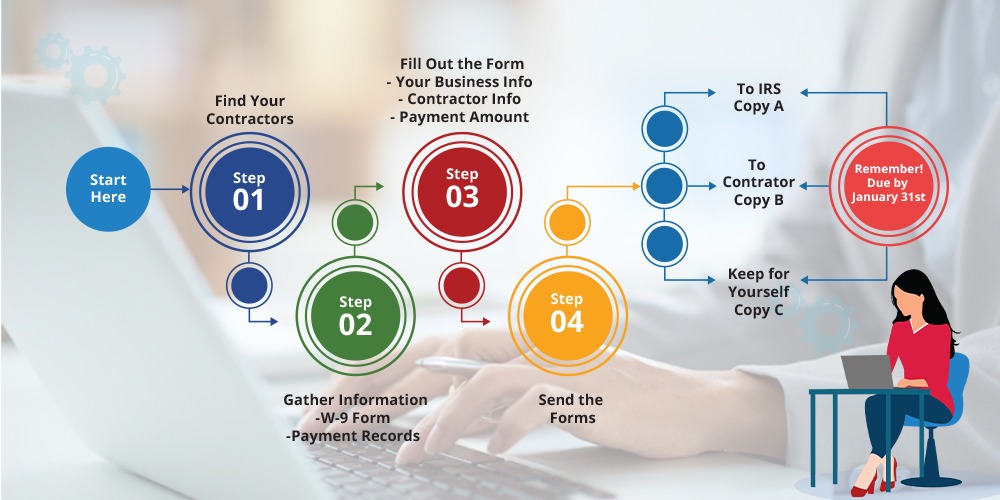

US-based businesses and independent contractors are required to file a 1099-Form, which is a tax form for independent contractors. Here is a step-by-step guide to filling out the 1099-Form.

Identifying the Independent Contractors

It is important to identify the independent contractors before filing the tax returns. After identifying the contractors and gathering the information, the next step is to complete the Form. Businesses should classify their employees and contractors to avoid hefty penalties for misclassifying employees and also independent contractors.

Understanding the 1099 Forms

In most circumstances, the independent contractor 1099 tax Form is not required. A 1099-Form is not needed for a paid corporation or a limited liability company, business travel reimbursements to employees, and payments made towards storage, freight, and merchandise. Knowing all these details will help taxpayers fill out the 1099-Form correctly.

Filling Out Form 1099

It is important to gather all the necessary documents and have them ready before starting to fill out the form. Taxpayers will require a W-9 tax Form for independent contractors before they provide any service. Sections that are required to be filled in the 1099-NEC tax Form are,

- Non-employee compensation – It is important to fill in the compensation that is paid to the non-employee.

- Company’s TIN and payer’s TIN- This includes the company’s TIN or the tax identification number.

- Company’s name and address – This information includes the business’s name and address. It is important to spell out all the details as per the official records.

- TIN of the recipient- This field will include the contractor’s TIN.

- Recipient’s name – The name of the independent contractor is filled in this field.

- Address of the recipient- List the contractor’s address.

- Federal and State income tax withholdings – This field will list the federal income tax withheld.

There is a separate section to list the state income earned, aligned with the company’s TIN for the state. The IRS does not require these details. However, the taxpayer may have to include them to make it easy for the contractor to state their income tax filings.

Submitting the IRS Tax Form

After filling out the tax Form, the next step is to submit the different copies of the Form to the different recipients. Copy A of the tax form for an independent contractor will be sent to the IRS. Copy B of the tax form will be sent to the contractors. The taxpayers should keep Copy C of the tax form for their records.

It is important to note the due date while submitting the tax Form. The due date for submitting the tax Form 1099- NEC is 31st January every year. If the deadline, 31st January falls on a weekend or a holiday, the due date to submit the 1099-NEC tax Form is the next business day. Therefore the taxpayer should provide the 1099 to the IRS and also the contractor before the due date.

E-filing the Tax Form 1099-NEC makes it easy to meet the deadline. However, certain states require businesses to file 1099 Form, and therefore it is important to check the state before considering e-filing the tax Form.

Penalties for Missing the 1099-NEC Form

There are significant penalties for missing the 1099-NEC tax form deadline for the contractor and the business. Missing a deadline can call for a penalty of USD 60 to USD 310, depending on how long it is past the deadline. For intentionally disregarding the 1099-NEC, the penalty could be around USD 630 or 10% of the total income reported.

Filing the 1099-NEC Tax Form Online

In order to file the IRS tax Form 1099, the taxpayers will require their employer identification number or EIN, the IRIS Transmitter Control Code, and the API client ID, which is specifically for the A2A filers only. Any person or organization can e-file IRS Form 1099-NEC, which includes individuals, small businesses, third-party tax filers, software developers, transmitters, large businesses, and tax-exempt organizations. There are some important points to remember while filing out the 1099- Form.

- It is important to have a written copy of the contract with the vendor

- It is important to get the W-9 tax Form from the vendor, before making the first payment to the 1099 Vendor.

- For the payments that are made to the attorneys and the medical corporations, it should be reported, even if the tax amount is below USD 600.

- W-9 tax Forms are confidential documents, and thus they should be secured properly to avoid identity theft.

- It is mandatory to conduct a 1099 report to make sure that all the information for the current year is updated on the accounting software.

When is it Required to File Form 1099- NEC? Tax Form for Independent Contractor

Businesses that are required to pay independent contractors must file Form 1099-NEC to report the payments for the services they have performed for their specific trade or business. If the following conditions are met, then a payment is generally required to be reported as non-employee compensation.

- The businesses have made payments to someone who is not their employee.

- The business has made the payment for the services in the course of its trade or business, including government agencies and non-profit organizations.

- A payment has been made to an individual, estate, or partnership, or in some cases, it could be a corporation as well.

- Payments have been made to the payee for at least $600 during the tax year.

Starting from the Tax Year 2020, taxpayers are required to make use of Form 1099-NEC, non-employee compensation, to report their payments of non-employee compensation that were previously reported on box 7 of the IRS Form 1099- MISC.

Payers generally make use of Form 1099-NEC to report payments that have been made in the course of the trade or the business. If you paid someone who is not your employee or a subcontractor or an attorney or accountant and the payment made is over $600 for the services provided during the tax year, IRS Form NEC needs to ber completed. A copy of the Form 1099-NEC should be provided to the independent contractor by January 31st of the tax year, following the payment. It is also important to send a copy of this Form to the IRS by 31st January.

It is also important to note here that these independent contractors may also have their own employees or might hire other independent contractors and subcontractors. In both cases, they should be very well aware of their tax responsibilities, which include their filing and reporting requirements for these workers.

Form 1099-NEC E-Filing Requirements

The IRS has made significant updates to the e-filing requirements of the 1099-NEC tax Form with effect from the 2023 tax year. According to this new mandate, businesses that file ten or more information return Forms within a calendar year are obliged to submit these Forms electronically. This is indeed a substantial change from the previous regulation, which set the electronic filing requirement at over 250 tax Forms. This regulation impacts the way businesses manage their file their information returns, especially the businesses that deal with independent contractor payments.

It is essential to consult tax professionals by businesses who own their business and are not sure about missing 1099 Forms. Taxpayers with questions regarding the 1099 Forms can also seek help with respect to reporting their non-employment income to the IRS properly.

The taxpayers are responsible for reporting their independent contractor income and to file their tax returns. But at times, they may be clueless as to where to seek help, to manage certain situations. This is where IRS-authorized e-filing service providers like Tax2efile come to the rescue of the tax filers. These tax experts help taxpayers to report all their income on the correct 1099 Form, without any errors and well within the tax filing deadline so that they don’t attract any penalty from the IRS.