- February 21, 2025

Filing the taxes is indeed a very stressful deal, as many times the taxpayers would find themselves running ahead of schedule when the deadline is approaching. Luckily they can resort to the Arizona individual returns extension for filing their tax returns. This offers them a lot of relief, especially if they require additional time to organize their documents and their finances. If you are living in Arizona, does an individual return in Arizona allow automatic extension? This blog is for you. It offers everything you need to know before availing the benefits of this extension.

Table of Contents

Everything You Need to Know About Making Arizona Tax Payments and Late Payments

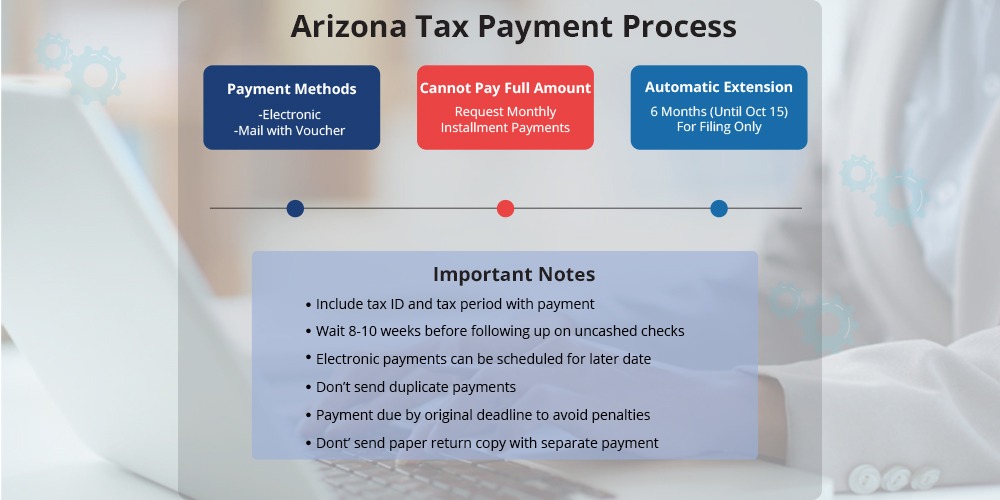

In order to make an individual Arizona income tax owed, the taxpayers can either do it by mail or electronically. The individuals should send their payment to the original tax return while mailing. Taxpayers who send the payment after mailing the return can mail their payments through a payment voucher to the address given on the Form. Also, taxpayers who have filed their tax returns already and have remitted their payments should not send a paper copy of the return with their payment separately.

Submitting the Tax Form Promptly

To submit the correct application of the payment and to avoid processing delays, the taxpayers should give their tax identification number and the tax periods for which they want the payments applied. Also, taxpayers who have already filed their tax returns and remitted their payments separately should not send a paper copy of their return along with the payment.

What If the Individuals are Not Able to Pay the Taxes?

In case the individuals are not able to pay the full amount owed to the tax department, they can ask for monthly installment payments when they file their tax returns. In order to avail of this request, they should wait until the ADOR processes their returns and sends them a billing notice.

Dealing with Uncashed Payments

Before contacting the Arizona Department of Revenue, with respect to an uncashed paper payment, the taxpayer should check their financial institution and verify if the check has been cleared in their account. They should allow the ADOR about 8 to 10 weeks of time to process the check before emailing or calling the Department. In case the full payment is postmarked by the due date, then they will accrue late payment penalties. Also, the ADOR encourages taxpayers to make payments electronically. The main advantage of electronic payments is that they can be scheduled for a later date, and they are also free for e-check. In case the tax payment has been made, the taxpayer need not send a duplicate check electronically.

Understanding the Arizona Automatic Extension

The state of Arizona will offer an automatic six-month extension for filing individual income tax returns. Hence, if the taxpayer is unable to file the state tax return by the original deadline of April 15, then he gets one by October 15.

Whereas certain states require taxpayers to file for this extension, Arizona grants it automatically, provided that taxpayers meet some conditions. This extension is only for filing the return and not for the payment of the due taxes.

The taxpayer must make payments by the original due date if there is any outstanding balance in order to avoid interest and penalty charges.

Who Qualified for an Automatic Tax Extension in Arizona?

Arizona individual taxpayers have the privilege of availing of an automatic extension. To avoid any penalties, at least 90% of the total tax liability should be paid by April 15. If the taxpayer is not able to abide by this, then the Arizona Department of Revenue may impose various penalties and interest upon the unpaid amount.

In case the taxpayer estimates either a refund or no additional taxes due, there is nothing to do to obtain the extension; the extension is granted automatically, and they can file by October 15 with no other forms required. In order to file an extension on the return, the taxpayers should make use of the Arizona Form 120 EXT to apply for a maximum of six months ‘ extension. The completed extension form should be filed by the original due date of the return unless the due date falls on a weekend or a legal holiday. In all these cases, the tax filing application should be postmarked on or before the business day before the holiday.

As this extension is not a request to extend the pay, the taxpayer will be liable for the extension underpayment penalty if at least 90 percent of the tax liability disclosed by the return has not been paid by the original due date of the return. For appropriate application of the payment and to avoid delays, the corporations should submit their payment along with the completed Form 120 EXT. The tax department would also accept a valid federal extension for the same period, covered by the Federal extension.

Filing an Individual Extension

To file an extension for their individual tax returns, individual taxpayers can make use of the Arizona Form 204 to apply for an automatic extension to file. The completed extension Form should be filed by 15 April 2025. For individuals who have filed a timely Form 204 for automatic extension, the due date for the Arizona tax return is 15th October 2025. To avoid the extension underpayment penalty, the taxpayers should pay at least 90 percent of the tax due by 15th April. To prompt payment applications and avoid delays, the taxpayers should submit their payments along with the completed Arizona Form 204.

Individuals who are filing under a federal extension or making an Arizona extension payment electronically need not file Arizona Form 204. They can make electronic payments through the link AZTaxes.gov by visiting the ‘make an individual/small business income payment’ link.

Additionally, taxpayers who have filed an extension with the IRS need not file the returns with the state, but they should check the filing under the extension box 82F of the Arizona tax returns when they make the filing. Individual taxpayers making the tax payments with their extension requests should use Form 204 in order to ensure that proper credits are made to their accounts.

Filing an Individual Estimated Payment

In order to file quarterly estimated individual income tax payments, individuals should use Form 140ES. Taxpayers should submit a separate form for each quarter for which the payment is made. The estimated tax payments are due by April 15, June 16, September 15, 2025, and January 15, 2026. Individuals who did not make these payments on a timely basis might incur a penalty.

If the taxpayers are filing electronically, they must make their payment through the AZTaxes.gov link and select the 140 ES: Estimated Payments link. If they are making an estimated payment using this link, this Form should not be mailed to the Department. ADOR will automatically apply the payment to their account.

In case the taxpayer has to make an estimated payment, their payments, when added to the Arizona withholding, should equal either 90% of the tax due for the current calendar year or 100% of the tax due for the previous calendar year.

Transaction Privilege Taxes

In order to make a payment towards the transaction privilege tax owed, the taxpayers can either do so electronically or through the mail. It is worth noting that Businesses with $500 or more in annual transaction privilege tax and use tax liability should pay electronically. The businesses should send the payment with the original return when mailing. Taxpayers who are sending the payment after mailing the return can mail the payments through a payment voucher to the address on the Form. Taxpayers who have already filed the tax returns and remitted their payments separately should not send a paper copy of the return with their payment.

Businesses that have received a billing notice should send the payment that is attached to the top portion of the billing notice received to the address provided. In order to send the correct application of payment and to avoid processing delays, the taxpayers should provide their TPT license number, tax periods, and TIN for which they want the payments to be applied on the check.

Do Arizona Individual Returns Allow Automatic Extensions?

The Arizona tax Form 204 can be used to apply for an extension of time. This tax Form can also be used to remit an extension payment whether they are requesting an Arizona extension or using a valid Federal extension tax Form. Please note if you make an electronic payment, an extension payment, or a credit card payment at the time of applying for a federal extension, then Form 204 need not be submitted. All applications for an extension must be postmarked by the time of the return due date unless that due date falls on a Saturday, Sunday, or legal holiday. If that is the case, any request would have to be postmarked by the next business day after such weekend or holiday.