- January 9, 2024

The IRS tax Form 1099 is an informational tax return Form that helps the IRS to learn the source of income for employees, apart from their salaries, wages, and tips. If you are an independent contractor, or if you are hiring one, then you should learn everything about IRS Form 1099.

Table of Contents

What is IRS Form 1099?

Businesses and individuals who pay more than $600 as income to a non-employee during the tax year should file Form 1099. This tax Form will help individuals report different sources of their income to the IRS. If a business reports its income, it will not be subject to traditional payroll tax withholding. But the recipient of the income should be responsible for reporting and paying taxes on the income, while they file their tax returns. It is mandatory to file this form with the IRS accurately and on time to avoid late filing penalties.

Tax payers can use this tax Form to report different types of income they earn during the tax year, such as,

- Their rental income

- Income they earn from their contract and freelancing work

- Investment Income

- Payments that are made to independent contractors

- Other types of income that are not subject to payroll tax withholding.

If the business has to file Form 1099 with the IRS, it should send a copy of the Form to the recipient of the payment by 31st January. It should also file a copy of the Form with the IRS by 28th February in paper format or by 31st March if the business is filing electronically.

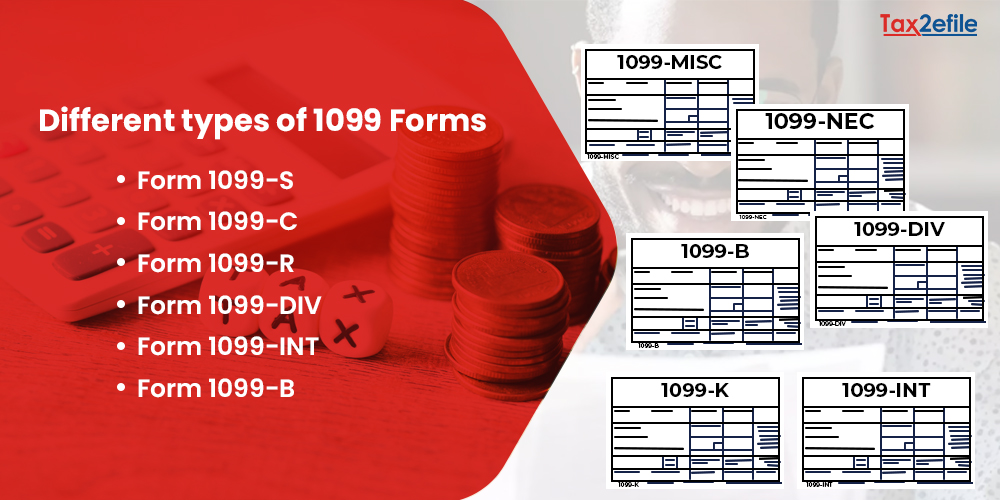

Different types of 1099 Forms and its uses

- Proceeds of the sales from real estate – Form 1099-S

- Canceled debt, such as mortgage debt and credit card balances – Form 1099-C

- Distributions from retirement accounts such as IRAs and 401 (k)s – Form 1099-R

- Dividend income earned from mutual funds and stocks- Form 1099-DIV

- Interest income earned from bonds, bank accounts, and other investments- Form 1099-INT

- Capital gains and losses that are earned from the sale of bonds, stocks, and other investments – Form 1099-B

Common mistakes to avoid while filing Form 1099

It is important to file IRS Forms on time and before the deadline. Moreover, It is also important to file the information correctly to avoid penalties from the IRS. apart from these two entities, it is also important to avoid certain mistakes while filing this tax Form.

- It is important to collect all the necessary information from the payees to properly fill out the Form. It is mandatory to have the correct name, address, and TIN of the payee.

- Each type of income demands a specific type of 1099 Form. Using the wrong Form will not be appreciated by the IRS. Therefore, it is important to choose the correct form on the basis of the payment made.

- The most important concern is to file the tax Form on time, if the deadline is surpassed, the IRS will levy hefty penalties.

- The tax payer should never fail to report all the payments. All payments of $600 and more made for non-employees during the tax year should be reported on Form 1099.

- If the taxpayer withholds taxes from the payment, they should report this amount on the Form.

E-Filing 1099 with Tax2efile

Apart from these aspects, taxpayers should make it a practice to keep accurate tax records for IRS audit. They can take help from IRS authorized E-filign service provider tax2efile to handle the 1099 Forms accurately and to avoid penalties.