- March 13, 2024

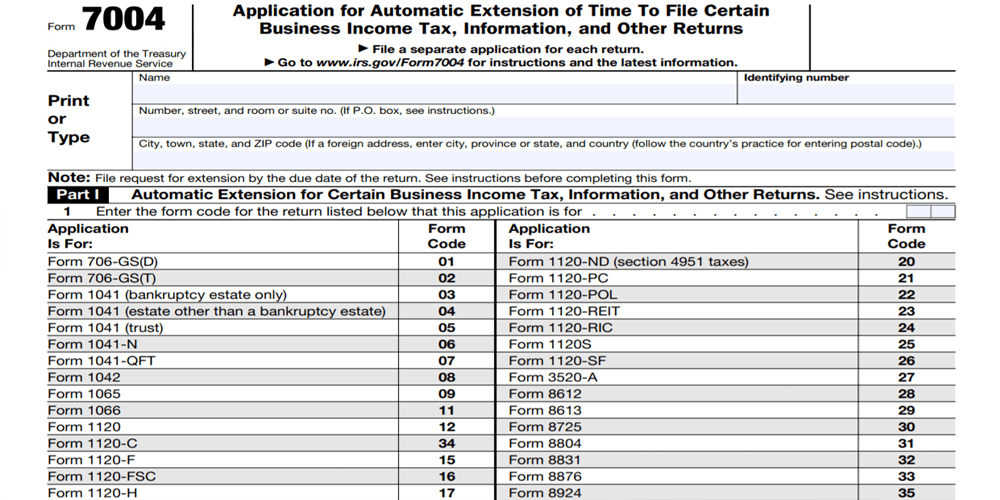

The IRS tax Form 7004 helps taxpayers file an automatic six-month extension of time to file certain information related to income tax and other returns. If you complete IRS Form 7004 properly, this extension will be granted. This is an important tax document that helps business owners request an extension for tax filing for certain tax forms. The IRS will use this tax Form to identify all the businesses that have requested an extension for tax filing and offer them those extensions.

Table of Contents

Understanding Form 7004

Taxpayers can make use of IRS Form 7004 to request an automatic time extension from the Internal Revenue Service to file certain business income taxes. The Form can also be used to request extensions for information and other returns. The extension will only be granted if the taxpayer completes Form 7004 properly after being given a proper estimate of the applicable tax. It is also mandatory to file Form 7004 within the due date of the tax return for which the extension has been requested. It is also important for the taxpayers to pay all the due taxes. The extension is only for submitting the relevant tax papers to the IRS and not for paying the applicable tax.

Also, taxpayers should not use IRS Form 7004 to get an automatic extension of time to file Form 1041-A. For this tax return, they have to use Form 8868. The deadline for filing Form 7004 is on or before the due date of the tax return, for which the taxpayer is requesting an extension. Taxpayers can file Form 7004 electronically for most of the returns. However, Form 7004 cannot be electronically filed for Forms 8612, 8613, 8725, 8876, 8831, and 706 – GS(D).

The IRS will not notify the taxpayer that the extension has been approved; it will only notify if the extension request has not been approved. The automatic extension period is allowed for six months. The IRS might also terminate the automatic extension period at any point by sending a notice of termination through the mail directly to the entity or person who requested the extension. The taxpayer will send the notice ten days in advance before the termination date given in the notice.

Eligibility Criteria For IRS Form 7004

IRS Form 7004 is officially known as the application for an automatic extension of time to file certain business income tax information and other returns. This tax Form helps the business to request an automatic extension of time to file certain tax returns. Partnerships, corporations, and S corporations can make use of this tax extension Form. Businesses that require more time to file their tax returns can consider filing Form 7004. IRS Form 7004 is used to request an automatic extension of time to file tax returns by partnerships, S-Corporations, Corporations, trusts, and estates. To be eligible to file Form 7004, the business should meet certain criteria. These criteria are as follows.

- The filing entity should be a partnership, corporation, trust, estate, or S corporation.

- It is important to file Form 7004 before the original due date of the tax return.

- The business should have a valid reason for a tax extension request.

Businesses can file Form 7004 either by mail or electronically. To file electronically, they can use an authorized E-filing service provider.

Extension Period, Termination, and Rounding Rules for Form 7004

The IRS Form 7004 will buy an automatic extension period of six months for filing the tax returns. Certain filers of Form 1041 and C corporations with tax years ending June 30 are extensions. Trusts filing Form 1041 and estates will get an automatic 5 ½ month tax filing extension. C corporations with tax years ending 30th June will get an automatic seven-month extension.

The IRS can terminate the automatic tax-filing extension at any time by mailing a notice of termination to the entity or taxpayer who has filed an extension. This notice will be mailed at least 10 days before the termination data that is given in the notice period. The entity can round off the cents to whole dollars on their returns and schedules. For effecting rounding off, it is important to drop amounts that are under 50 cents and increase the amount from 50 to 99 cents to the nearest dollar. If the taxpayer adds two or more amounts to include in the total tax, it is important to include the cents and round off only the total amount.

Importance of Depositing Estimated Taxes

The IRS clearly states that IRS Form 7004 buys time to file the tax return only. An extension of time to file the tax return does not grant an extension of time to pay the concerned taxes. Thus, taxpayers and entities should estimate their taxes in advance and pay their owed taxes within the deadline to avoid possible penalties.

Taxpayers can also get an extension electronically by paying part or all of their estimated income tax due and by stating that the payment is for the extension. If the taxpayer selects an extension while making the tax payment, then they don’t have to file a separate extension form, and they will receive confirmation of the same for their records.

Common Mistakes To Avoid While Filing IRS Form 7004

The IRS generally charges a penalty if the tax return is filed after the due date unless there is a reasonable cause for not filing the returns on time. In order to avoid penalties, it is important to file IRS Form 7004, which takes an additional 6 months, to file the returns with the IRS. While filing Form 7004, it is important to avoid certain mistakes, and they are as follows.

- If the taxpayer changes his or her name after filing the previous year’s tax returns, it is important to enter the name as given on the previous year’s income tax return. If the name given does not match the IRS database, then the taxpayer may not get a valid extension.

- Failing to file the IRS 7004 Form before the due date might result in interest and penalties. The penalty for failing to file Form 7004 is 5% of the tax owed for each month, up to a maximum of 25% of the tax owed.

- Taxpayers should make sure that they sign the tax Form with the date before submitting it to the IRS. The IRS requires a valid signature to validate the extension request. Without a proper signature and the date, the extension may not be considered valid, and the taxpayer could face penalties.

- The taxpayer should retain a copy of the tax Form for their records. This helps with future reference and documentation processes. It also serves as proof of filing an extension request in case of future discrepancies.

Navigating with Tax2efile

Electronic E-filing is the best option when it comes to IRS Form 7004. E-filing of the tax Forms can be done with IRS-authorized e-filing service providers like Tax2efile. Getting started with Tax2efile is also a simple and hassle-free process. Users should create their account with Tax2efile and choose Form 7004 extension from the menu list offered on the website.

Users should enter their business information and the applicable business entity type. The business should enter their tax year information and tax form details and also enter their tax calculation details. Finally, they have to check and submit the tax Form to the IRS. After submitting the tax Form, the tax filers will receive an email confirmation from Tax2efile, with a status update from the IRS.

Before filing the tax returns, taxpayers should gather all the required documents, such as their

- Business information – including the name, employee identifying number, and business address.

- Details about the type of their business – whether it is a corporation, partnership, etc.

- Type of the Tax Form for which the business is requesting a tax extension.

- An estimate of the amount of the tax that the business owes to the IRS.

There are several advantages to choosing to file IRS Form 7004 with Tax2efile. The portal has advanced accounting software that helps users file multiple Form 7004s through a single account. Registering with Tax2efile is a simple and easy process and they also offer the lowest prices in the industry. With the help of its automatic error-checking process, users can avoid errors and last-minute form rejections. The portal has expert technical support from the US to guide users through calls and chats.

Extending Your Federal Tax Filing Deadline

IRS Form 7004 extends filing deadlines for federal tax returns, aiding businesses and individuals with extra time. Extending tax deadlines offers businesses crucial time to ensure accurate documentation before filing. Filing this tax form electronically is easy and straightforward, but it must be submitted before the deadline expires. Filers should, however, understand the purpose and requirements of Form 7004 to avoid unwanted penalties and interest charges. Utilizing this tax form helps businesses meet IRS regulations, manage tax obligations, and ensure compliance.