- November 26, 2024

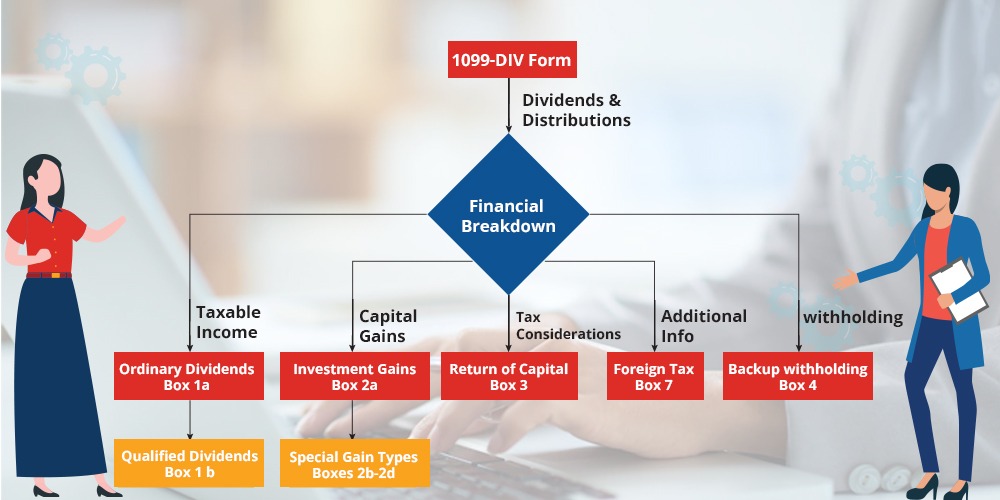

The banks and other financial institutions will use the IRS Tax Form 1099-DIV to report dividends and other distributions to the taxpayers and the Internal Revenue Service. The taxpayers need not file the 1099-DIV with the IRS, but they need this information to prepare their tax returns. This tax Form also includes several boxes that report the different types of income, which include ordinary dividends, qualified dividends, and capital gain distributions.

Table of Contents

Dividend Income

Dividend income refers to the distribution of the earnings to the applicable shareholders. U.S. taxpayers who have earned at least $10 as dividend income will receive IRS tax Form 1099-DIV if they have earned their dividend income from their brokerage, along with their consolidated IRS 1099-DIV Tax Form.

Capital Gain Distributions

When an investment makes a distribution of its earnings to the taxpayer and reports it in box 2a of Form 1099-DIV, the IRS generally allows the taxpayer to treat the distribution as a long-term capital gain. This could be beneficial if the same tax rules apply to the qualified dividends and will also apply to the qualified capital gain distributions, irrelevant of whether the investment was held for 10 days or 10 years.

Ordinary and Qualified Dividends

The 1099-DIV Form uses terms such as ordinary, qualified, and non-qualified to signify the designation of the dividend issuer. These terms are given for a reason. Non-qualified dividends will be considered ordinary dividends, meaning that they are taxable like ordinary income. Some of these dividends are eligible for a qualified tax rate at the rate of the capital gains.

There are two criteria for making a dividend qualified. The issuer should be a domestic company or a qualified foreign corporation. To be eligible to claim the qualified rate, the issuer must meet the holding period requirements set by the IRS. The shareholder is expected to own the stock for more than 60 days during the 121-day period that begins at least 60 days before the ex-dividend date.

Return of capital or the non-dividend distribution will also be listed on the IRS Form 1099-DIV. These distributions are, however, non-taxable in the sense that they will not be included as dividend income, but they will be used as a cost-basis adjustment against the underlying asset. Other classifications on the 1099-DIV also include many cash and non-cash liquidated distributions, investment expenses, and the foreign tax withheld. It is thus mandatory to read and understand the documentation provided by the issuer to learn what these terms mean and why they are being passed on to the taxpayer.

Spillover Dividends

The dividends received from the mutual fund or real estate investment trust in January will show up on the previous year’s tax Form. This type of dividend is also called a spillover dividend because the issuer uses the declaration date and not the payment date as a point of reference for tax reporting. In effect, the payment will fall into the next year’s statement, but it is much taxable for the previous year. This is one of the many reasons, why it makes sense to the taxes after receiving the IRS Form 1099-DIV.

Who Should File IRS Form 1099-DIV?

Companies will provide a copy of the IRS Tax Form to the investor and also to the IRS. Banks, investment companies, and other financial institutions are required to provide taxpayers with the 1099-DIV Form by 31 January every year. Most of the investors who will receive Form 1099-DIV will have ordinary dividends, qualified dividends, and total capital gains.

This Tax Form will include the name and the address of the recipient, their Social Security Number, the name of the payer, the address of the taxpayer, the plan number, and the identification number. The right side of the Form will outline some of the most important figures that the recipient will require, namely the total ordinary dividends, qualified dividends, and the total capital gain distribution.

Investors may also be subject to the Foreign Account Tax Compliance Act filing requirements for foreign accounts. This law demands that U.S. citizens, both in the country and abroad, file reports on foreign account holdings in U.S. dollars.

How to file the IRS Form 1099-Div – Dividends and Distributions

The IRS Tax Form 1099-DIV has three copies. The copy A of this tax Form will be red and is given for information purposes only, and they should not be printed. One copy of the Form will be given to the recipient, while the other will be attached to the tax return for the state tax department. This section will be given in black and can be used to fill out the details and satisfy the requirements of the recipient.

Taxpayers are required to fill in all the information on each Form 1099-DIV that they receive on their annual tax Form. This can be performed on the Schedule B form or directly on the Form 1040. Taxpayers who receive more than $1,500 in taxable interest and/or ordinary dividends during the year are required to fill out Schedule B of the Form, which accompanies the IRS 1040 tax Form.

Dividends will be taxed at the investor’s income tax rate with very few exceptions. The qualified dividends are the primary exception, and they have met certain criteria that allow them to be taxed at a lower tax rate for reporting capital gains. This tax rate on capital gains can also vary from the ordinary income tax rate.

Instructions for Filing IRS Form 1099-DIV

The different boxes available in IRS Form 1099-DIV and the instructions for filling them out are as follows.

Box 1a: This box will show the total ordinary dividends that are taxable. This box will include the amount on the ordinary dividends line of Form 1040. This is also reported on Schedule B if required.

Box 1b: This box will show portions of the amount in box 1a that might be eligible for the reduced capital gains rates.

Box 2a: This box shows the total capital gain distributions from a regulated investment company or a real estate investment trust.

Box 2b: Shows the portion of the amount given in box 2a, which is an unrecaptured section 1250 gain from some depreciable real property.

Box 2c: This box gives the part of the amount given in box 2a, which is section 1202 gain from certain small business stock that might be subject to an exclusion.

Box 2d: This gives the portion of the amount in box 2a a 28% rate gain from sales and exchanges of collectibles.

Box 2e: Shows that a portion of the amount in box 1a that section 897 gained that attributed to the disposition of U.S. real property interests.

Box 2f: Shows the portion of the amount in box 2a, which is section 897 gain that is attributed to the disposition of USRPI.

Box 3: It shows the return on capital. To the extent of your cost in the stock, the distribution will reduce the basis and is not taxable.

Box 4: This box shows backup withholding. If you did not give your TIN to the payer, a prayer must be backed up withheld on certain payments.

Box 5: Shows the portion of the amount in box 1a that may be eligible for the 20% qualified business income deduction under Section 199A.

Box 6: Shows the share of expenses of non-publicly offered RIC.

Box 7: Shows that foreign tax that you may be able to claim as a deduction or a credit on Form 1040.

Box 8: This is left blank if RIC reported the foreign tax shown in box 7.

Box 9 and 10: It shows cash and noncash liquidation distributions.

Box 11: If the FATCA box is checked, the payer will report it on Form 1099 to satisfy the account reporting requirement under Chapter 4 of the Internal Revenue Code.

Box 12: It shows exempt interest dividends from mutual funds and other RIC paid during the calendar year.

Box 13: Shows exempt-interest dividends that are subject to alternative minimum tax.

Box 14-16: These boxes are for reporting income tax withheld.

IRS Form 1099- DIV Schedule B Implications

The taxpayer’s receipt of dividends may also require them to prepare the Schedule B attachment of the tax return. Even if the taxpayer has not received Form 1099-DIV, they will be required to still report all of their taxable dividend income. Schedule B will be necessary when the total amount of dividends and other interest that they receive exceeds $1,500. However, Schedule B doesn’t change the amount of tax that the taxpayer will pay. It will only require the taxpayer to report the information regarding the dividend and the interest income that they will receive from each of the sources.

The IRS Tax Form 1099-DIV is required to report dividends and distributions paid to taxpayers by banks and other financial institutions. This will include ordinary and qualified dividends, the federal income tax withheld, the total capital gains, foreign tax paid, etc. Taxpayers can report the information on Form 1099-DIV on Schedule B or Form 1040 directly. Tax experts like Tax2efile will be able to assess the unique situation of the taxpayer and file Form 1099-DIV perfectly with 100% accuracy. The experts will uncover the industry-specific deductions to avail more tax breaks and file the taxes for you.