- September 18, 2024

The Internal Revenue Service recommends its taxpayers online tax filing, as it is an easy, secure, and fast process. E-filing the tax papers helps mitigate tax filing errors and also helps taxpayers get their refunds faster. Tax2efile is an IRS-authorized e-filing service provider that helps businesses and individuals to file their Federal tax returns and extensions faster. With Tax2efile, it is a process to file tax returns electronically without any hassle, and they can be easily expedited through the taxing process.

Table of Contents

State and Federal Taxes in the US

The United States follows a multi-tiered income tax system, under which the citizens have to file their tax returns with the Federal government, state, and local governments. Both the federal and state income taxes are similar in that they apply a percentage rate to the taxable income. However, they also differ with respect to their rates and how they are applied, by the type of taxable income and the tax credits and deductions allowed on them.

The state income taxes vary considerably from one state to another in the United States, with most of them following a progressive income tax system. Some of them, however, follow a flat tax system as well. In the states that follow the progressive tax systems, the greater income levels would be taxed at a high percentage. Some states also implement tax brackets to complement the federal tax code, and some implement their own codes as well. Some states also adjust their tax brackets to stay on par with the inflation, similar to what the federal government does, while others do not do that.

The Federal tax rules in the United States have undergone significant changes since 2018, especially with the passage of the Tax Cuts and Jobs Act. There are seven marginal tax brackets at the Federal level, between 10% and 35%. With both state and federal taxes, taxpayers might claim either a standard or an itemized deduction under the federal tax system, and this can be best put into effect through online tax filing.

Both the Federal and state governments will differ in terms of the type of income they tax, the tax deductions they allow, and the tax credits they allow. For example, there are exemptions in the earnings from US Treasure Securities and savings bonds. Pension and social security income are taxable under federal rules, whereas some US states exempt these income from taxation. Since there are a lot of differences between the Federal and the State taxation systems, taxpayers have to keenly follow the tax deductions allowed by both to help save on their taxes. This can be best achieved by choosing online tax filing systems.

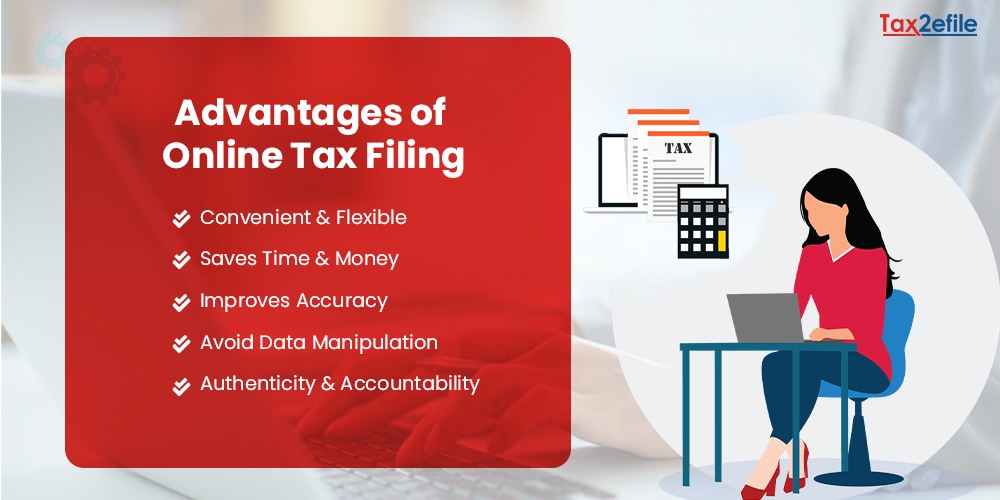

Advantages of Online Tax Filing of Tax Returns

Online tax filing is the process of filing taxes electronically, with the help of online software approved by the relevant tax authority authorized by the Internal Revenue Service, such as Tax2efile. Electronic filing has become increasingly popular owing to the array of benefits that it offers. The advantages of e-filing the tax returns are as follows.

It is a Very Convenient and Flexible Process

E-filing has brought a lot of flexibility to the e-filing of tax returns. It is also a very convenient process, as the taxpayers are able to do it at the convenience of their home and workstation. They are able to file their returns at any time of day during work hours.

Helps to Save a Lot of Time and Money

Online tax filing is one of the best ways to save a lot of time and money. When the tax returns are e-filed, the data gets transmitted online from the server of the e-filer to the servers of the tax agency. This process saves time and money from transferring the data from paper to online input and also helps avoid transmission errors.

Improves Accuracy

Online filing prevents transmission errors, thus improving the accuracy of the data records and the overall process of tax filing

Avoid Data Manipulation of Tax Records

E-filing leaves no room for the manipulation of the data records. With the help of e-filing, interconnectivity and the availability of data are easily achieved. It is also possible to link data and also trace it back towards a tax-paying unit.

Authenticity and Accountability

E-filing has enhanced the authenticity of the tax filing process and has also increased the accountability of both the taxpayer and the tax agency. Filing the tax returns on paper is ambiguous, as there are chances of very high ambiguity on the receipts of the tax records and the tax papers. While choosing online tax filing, it is possible to get the stamped Schedule 1 copy of the tax return in the mail to the taxpayer within 24 hours. Thus, there is a very high level of certainty in the tax filing process.

Online Tax Filing with Tax2efile

Tax2efile is an IRS-authorized e-filing service provider that offers the most advanced, safe, and secure e-filing solutions to ensure that tax files are filed easily and quickly. They allow taxpayers to file their taxes at their own convenient time, and get the stamped Schedule 1 copy on their mail within minutes. It has also partnered with organizations such as Women in Trucking, NACTP, etc, and helps taxpayers with the latest innovations in electronic tax filing technology. There are many advantages of choosing online tax filing with Tax2efile, and they are as follows.

- Taxpayers can complete their tax returns within a few minutes and can also receive the IRS responses within 24 to 48 hours.

- They can be their own tax pro, and file their tax returns anytime and anywhere with the help of the user-friendly website.

- Taxpayers can avail of live support from professionals based in USA. They will guide the taxpayers throughout the e-filing process either over call or chat in English and Spanish languages.

- Tax2efile offers its services at an affordable cost and also offers discount coupons for its customers.

- They also have a dedicated cyber security team to protect all personal and important information of their clients, at every single step.

In order to complete the tax filing process, the taxpayer should first log in and register in the portal. They then have to select the tax Form that they wish to file their returns on. The third step is to add the tax details and make the payment to submit the tax Form to the IRS. The tax filing process is finally complete and taxpayers should only have to wait for their email confirmation.

Unique Features of Online Tax Filing with Tax2efile

Tax2efile is an IRS-approved service provider that helps both individuals and businesses file their Federal tax returns and tax extensions. With Tax2efile, taxpayers would be able to file their taxes accordingly, without any hassles, and will be expedited throughout the taxation process. Some of the unique features of the Tax2efile online tax filing system are as follows.

- Creating an account with Tax2efile is absolutely free

- After the taxpayers file their tax Forms with us and the IRS accepts their filing, they will receive SMS and Email confirmation immediately.

- The Tax2efile online portal helps in automatic tax calculation

- All the data that the tap payers give to us will be kept very confidential and secure in our portal.

- Customers will get answers to all their queries from the best customer support team based in the US.

- They will get access to a copy of their stamped Schedule 1 copy instantly

- They will also be able to correct and resubmit their rejected tax filings, absolutely free of cost.

Tax2efile Mobile App For Instant Online Tax Filing

Tax2efile eases the online tax filing process and allows taxpayers to file their taxes on the go with the help of their simple and easy-to-use mobile application. This mobile app is very simple and is free to download from iOS devices and Android devices. With the help of this application, it is possible to complete the tax filing process from anywhere and at any time. The app is available for smartphones and other compatible gadgets as well. Users can easily download the Tax2efile app for free and start filing the returns instantly. E-filing through the Tax2efile app is extremely simple and secure and users can start filing the returns from any place.

The app is extremely user-friendly and easy to navigate as well. Users of the Tax2efile app will not find much difference between web and app filing, except for the reason that tax filing has become more handy than before. The app is available for both Android and iOS devices. The app allows the taxpayers to pay their taxes within minutes and it is possible to file them through iPad, iPhone, and Android devices. Users can download the app from their iOS and Google Play store and start filing their returns.

Tax2efile has made online tax filing a lot easier and simpler for tax filers. They will be able to file their returns without any mistakes and also avoid late filing penalties. They can also get their stamped Schedule 1 copy of the tax return in their mail instantly. The entire process is easy, handy, simple, and cost-effective as well, making it an ideal partner for IRS tax filing.