- March 20, 2024

The Internal Revenue Service offers a series of 1099 Forms to help its citizens report their non-employment income to the government during the tax year. Form 1099 helps to report interest income from the bank, dividends from investments, and income from freelance work. Issuers of the 1099 tax Forms should send one copy to the IRS and another to the taxpayer or the income recipient.

Table of Contents

Understanding 1099 IRS Tax Forms

The 1099 IRS tax Forms helps taxpayers in the United States report their income so that the IRS can easily collect the appropriate taxes. The IRS considers Form 1099 an information return Form, and it includes non-employment income such as IRA distributions and independent contractor pay. Individual taxpayers will not fill out 1099 forms. Small business owners who hire independent contractors should file the Form with the IRS before the prescribed deadline.

Different Types of IRS Tax Forms

There are different types of 1099 Forms to report information on interest income, dividends, original issue discounts, etc. Let us discuss these Forms in detail here.

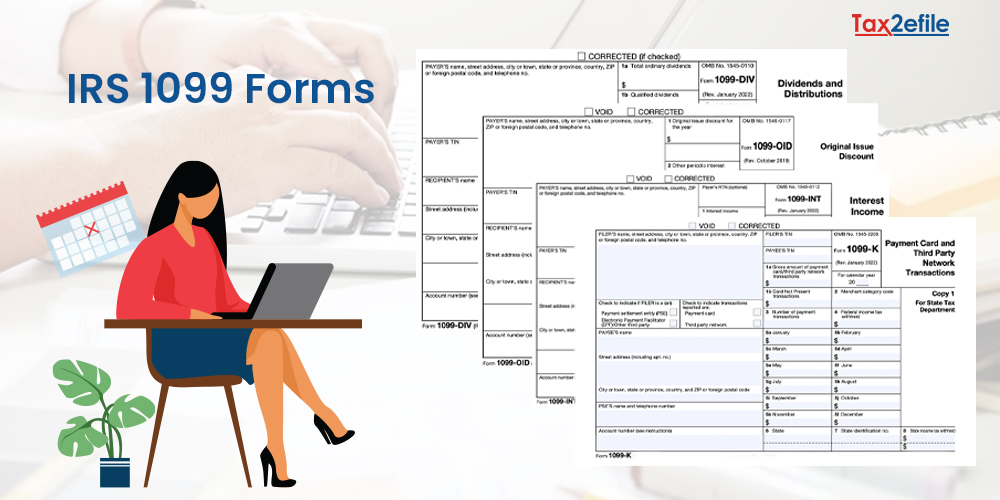

1099-DIV (Dividends and Distributions)

Banks and other financial institutions use the IRS tax Form 1099-DIV to report dividends and other distributions to taxpayers and the IRS. The banks send it to investors who receive dividends and distributions for all types of investments during the calendar year. Investors can get multiple 1099-DIV Forms. Each of these forms should be reported on the investor’s tax filing. However, investors will not receive 1099-DIV forms if their cumulative dividends are not greater than $10. The deadline for submitting this tax Form to the IRS is January 31st each year.

This Form will include the recipient’s name, recipient’s address, and their social security number. It will also include the name, address, identification number, and plan number of the recipient. Most of the investors who receive this Form would have received either ordinary or qualified dividends or total capital gains. Other categories include non-dividend distributions, investment expenses, Foreign tax paid, cash liquidation distributions, exempt-interest dividends, state tax withheld, etc.

1099-OID (Original Issue Discount)

Form 1099- OID or the Original Issue Discount tax form refers to the tax on the excess of the stated redemption price of an obligation during its maturity. It is a taxable income, as it is based on the interest over the life of the obligation. OIDs are generally levied over bonds, notes, debentures, certificates, and other evidence of indebtedness having a term of more than a year.

Form 1099- OID corresponds only to the certificates of deposits, time deposits, and bonus savings plans. It might also appeal to other deposit arrangements if the payment of the interest on the deposits is deferred until maturity. Taxpayers will receive Form 1099-OID if the OID to be included with the gross income is at $10 or more and if the provider of the FOrm paid or withheld any foreign tax on the OID for the taxpayer. If the taxpayer has withheld federal income tax under the backup withholding rules, then they will receive IRS Form 1099-OID even if the withheld amount is less than $10.

The rules for including OID in income generally do not apply to US savings bonds, tax-exempt obligations, and loans of $10,000 or less between individuals who are not in the business of lending money.

1099-INT (Interest Income)

This IRS tax Form reports interest income and is issued by all entities that pay interest income to investors during the tax year. It will include a breakdown of all types of interest income and related expenses. Taxpayers will issue Form 1099-INT by January 31st of the new year for any party to whom they have paid at least $10 of interest during the tax year. One copy of the tax Form goes to the IRS, and the other copy is sent to the taxpayer.

Income that is to be reported on Form 1099- INT includes the interest received on the bank deposits, the accumulated dividends paid by the life insurance company, etc. It also includes details on the indebtedness issued to the public in the form of bonds, debentures, certificates, and notes other than those from the US treasury. Amounts from which the federal income tax or foreign tax was withheld are also reported in Form 1099-INT.

1099-K (Payment Card and Third-Party Network Transactions)

Taxpayers will receive IRS Form 1099-K if they have received payments from any of the payment card transactions or any third-party network transactions beyond a certain threshold during the year. A payment card transaction uses a payment card or any associated account number for payment. A third-party payment network settles third-party transactions. The IRS changed the threshold amount for tax years 2023 and 2024 during November 2023 and ensured to report 1099-K income on Schedule C of the tax Form.

Taxpayers will receive Form 1099-K by 31st January if they have received any payments from the payment card transactions during the previous calendar year. The payment card transactions include debit cards, credit cards, and stored value cards. They will also receive Form 1099-K in settlement of third-party payment network transactions, such as PayPal, Zelle, etc, for the 2023 tax year if they received gross payments of more than $20,000 and have performed more than 200 transactions. For the tax year 2024, the IRS is planning a threshold of $5,000 in gross payments to phase in the requirements of the American Rescue Plan.

Simplifying The IRS 1099 Tax Forms

Understanding the different tax forms and gathering the required documents that help to file taxes on time can ease the stress of tax season for most individuals. The most important point to remember is to stay ahead of the game and file taxes early. Last-minute scrambling overwhelms taxpayers and forces them to miss important documents and make errors while filing tax Forms.

As the 1099 Forms are for freelancers and independent contractors, there are additional tax documents that one needs to gather to accurately report their income and expenses. These documents include:

- Income statements: To record the revenue and expenses of the business.

- Bank and credit card statements: It helps to verify the expenses and the income if they are not given in detail in the profit and loss statements.

- Payroll documents: This is mandatory for businesses with regular employees, and they need to gather both W-2 documents and 1099 Tax Forms.

- Receipts for expenses: These forms help the taxpayer to claim deductions.

- Previous year tax returns: This helps with reference in filing the tax Forms.

- Loan documents: Helps in reporting interest expenses.

- Inventory records: Helps businesses that deal with inventory

- Records of asset purchases or sales: Helps in calculating depreciation and in performing gain and loss calculations.

Your Trusted Partner in E-Filing 1099 IRS Tax Forms

The IRS Tax Forms help to report different types of income that the taxpayer receives, excluding their salaries and their wages, to the IRS. There are different kinds of tax Forms to help file different kinds of income the entities receive. Tax2efile helps in the electronic filing of tax returns for simplified processing and error-free filing within very few simple steps. Some good reasons why Tax2efile is your trusted partner in E-filing 1099 tax Forms are as follows.

- Tax2efile helps with the electronic filing of tax return forms.

- The portal allows tax filers to submit their tax returns online in a quick, secure, and reliable way.

- Tax2efile offers paper copies of the tax documents to the tax filers to ensure that they have quick access to them, whenever they require.

- Upon the successful submission of the tax Forms through Tax2efile, the users will receive an email confirmation for Form submission, along with copies of the filed returns and the receipts of the fees paid.

Tax2efile has a user-friendly IRS 1099 tax Form filing process and helps taxpayers with all the required tax filing tips. The experts at the portal will guide the users step-by-step through the filing process until they submit the form and receive the reference number to track the filed tax paper. Our E-filing portal ensures secure maintenance of all personal and financial information, keeping it confidential.

Tax2efile IRS Authorized E-Filing Service Provider

Tax2efile is an IRS-authorized and certified E-filing service provider that the IRS Oversight Board authorizes. The portal helps users stay up to date with IRS tax Forms, laws, and changes. Their friendly staff will guide taxpayers and businesses through the tax filing process while ensuring compliance with IRS regulations. They also offer free corrections on tax Forms, free TIN checks, bulk uploads of tax Forms, and friendly customer support service. Their advanced and highly secured services facilitate electronic filing of the 1099 tax Forms within the due date to avoid late filing penalties. Taxpayers and businesses can register with Tax2efile and start filing their 1099 Forms online without any hassle.