- February 8, 2024

Citizens use the IRS tax Form 1099-SA to report their distributions from Health Savings Accounts. This tax Form serves as a record of the money that has been withdrawn from HSA during the tax year. These distributions have significant tax implications, and thus, learning to navigate Form 1099-SA is crucial for anyone with HSA. The health savings account is a savings account where individuals will save money for their qualified medical expenses. Contributions towards this savings account are tax-deductible, and its funds can be used for qualified medical expenses without taxes.

Table of Contents

Form 1099-SA for reporting HSA contributions

Form 1099-SA is critical for HSA account holders and it also helps the IRS to track the HSA distributions by individuals. It ensures that they are used only for qualified medical expenses and are also reported on the tax return form. Funds in the HSA account that are used for qualified medical expenses are not taxed. Such expenses should be reported on Form 8889 while filing returns through 1040. If the funds are not used for qualified medical expenses, then they are categorized as taxable income. They also incur an additional 20% of HSA tax.

Rolling over HSA Funds

Rolling over HSA funds corresponds to money transfers from one HSA account to another without incurring penalties and taxes. This rollover should be completed in 60 days, and it should be a one-time occurrence within a 12-month period. It is important to maintain transparent and accurate records and maintain the IRS guidelines while handling rollovers.

Who should file Form 1099-SA?

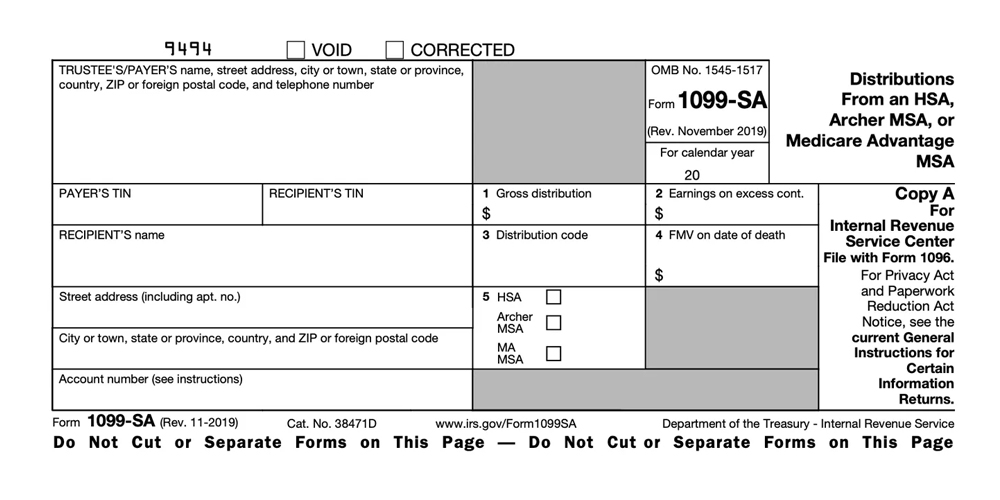

This tax Form is filed by the providers of the MSA and HSA, including the Medicare and Archer MSAs. These tax Forms are generally sent to individual account holders and also the Internal Revenue Service. Similar to other 1099 Forms, the issuing authority should send the Form to the taxpayer by 31st January each year. Taxpayers can deduct the contributions for the year they made them and can use these funds without any taxes as long as the withdrawals are made on qualifying health expenses. They can also use the health expenses for the account beneficiary or the beneficiary spouse or dependents.

When are the distributions for HSA taxable?

Taxpayers should include the HSA distributions in their income if they did not use the distributions from the HSA or MSA account for qualified medical expenses. If the taxpayer has made excess contributions to the Health Savings Account and has earned on those contributions, then taxes will apply. If they have withdrawn the excess payments and the earnings by the due date of the income tax return, they should include the earnings in the income in the year they received the distribution.

Apart from this, the IRS will levy a 6% excise tax for each year for excess individual and employer contributions towards the HSA account. Taxpayers can repay the mistaken distribution from the HSA not later than April 15. Following the first year they came to know that the distribution was made as a mistake.

Special rules will apply if the citizen has inherited an HSA or MSA account from their deceased spouse. In case of inheritance of HSA, then the IRS has special instructions for Form 8889. After inheriting the account, they should report the fair market value of the account as an income on their tax return. Earnings on the account after the death of the spouse are also taxable, and this should be included on the other income line of the tax return.

There are three copies of the IRS Form 1099-SA. The financial institutions that manage the account file copy A of the Form with the IRS will send Copy B of the Form to the taxpayer and retain Copy C. Citizens will receive the Form in their mail and should retain it for their records.