- March 11, 2025

The IRS tax Form 1099-PATR helps taxpayers report taxable distributions that are received from the cooperatives. This IRS Form will be sent to the taxpayers to allow them to report the distributions that they have received from the co-operative and might be included in the taxable income. This tax Form is part of the 1099 series of forms from the IRS that helps taxpayers report the income they have received from different sources.

Table of Contents

What is IRS Form 1099-PATR?

The taxpayers will receive IRS Form 1099-PATR if they have paid at least $10 in patronage dividends and other distributions by a co-operative in the previous tax year, as described in the Internal Revenue Code. A patronage dividend or distribution is when a cooperative pays its members or investors on the basis of the profit that the business has earned.

This tax form is used predominantly to report dividends associated with farming. Taxpayers can also receive it for other reasons, including the Federal income tax withheld in connection with the cooperative under the backup withholding rules, regardless of the amount of payment. The taxpayers would enter this information into their tax return under the general business or farming income.

Who Gets the 1099-PATR IRS Form?

The taxpayers who have earned at least $10 as patronage dividends and as other distributions from a co-operative will generally be sent a 1099-PATR tax Form. This tax Form is generally used to report the dividends that are associated with the farms. It can also be sent to taxpayers who have Federal income tax withheld in connection with a co-operative. In some instances, the tax Form will give information regarding the share of deduction that the tax code allows the co-operative to claim.

The Information Included in the 1099-PATR Tax Form

The 1099-PATR tax Form will include all or part of the TIN or the taxpayer identification number. It will also include the Social Security Number, the Employee Identification Number, and the taxpayer identification number. This tax Form will also include information pertaining to the account number and the amount that was paid. The amount that is paid will be given in detail if the taxpayer was part of the farmer’s cooperative. It might also include information such as the allocations paid in cash, qualified per-unit retain certificates, and other property details.

The form will give the Federal income that was withheld in case the taxpayer didn’t give the correct TIN to the cooperative. The Form shows the share of deductions that the tax code allows the co-operative to claim under the regulations that are part of the Tax Cuts and the Jobs Act.

Additional information shown on the 1099-PATR tax form includes the share of the cooperative Internal Revenue Code Section deduction passed on to the taxpayer. This amount is generally designated in a written notice that is sent to the taxpayer from the co-operative and also equals the number of qualified payments paid to the taxpayer on to which the co-operative computed its deduction under Section 199A (g). Some of these items might also qualify as items from businesses or trades that are not SSTB for deduction under Section 199 (A).

All copies of Form 1099-PATR are available on the IRS website, and this tax Form will also show the Federal tax credits. This will include investment credits, work opportunity credits, and other credits for refined fuel, renewable energy, small employer health insurance premiums, and empowerment zones.

Get Started by Registering with Tax2efile Today!

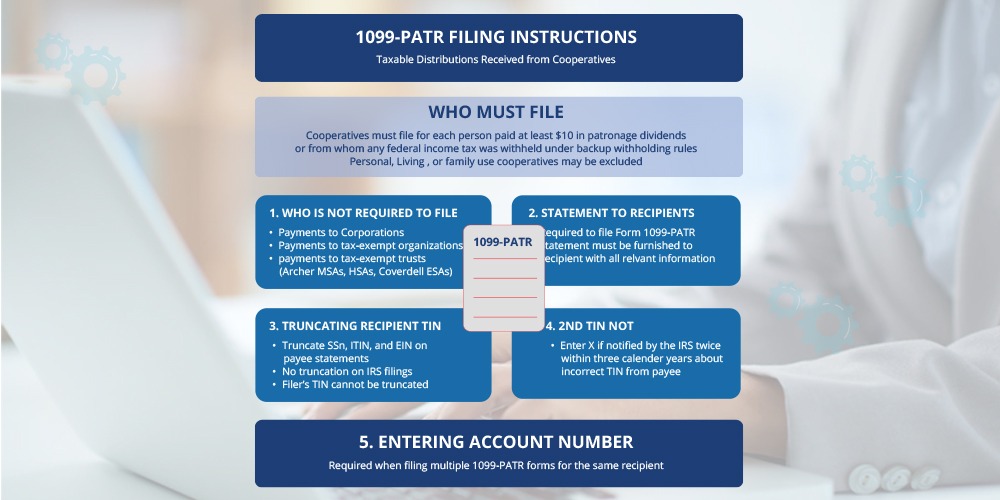

1099-PATR Filing Instructions

The taxpayers are required to file Form 1099-PATR, which corresponds to taxable distributions received from co-operatives for each person to whom the co-operative has paid at least $10 in patronage dividends and other distributions that are described in section 6044 (b) or from whom the taxpayer has withheld any federal income tax under the backup withholding rules, regardless of the amount of payment. Cooperatives that sell products or services largely for personal, living, or family use may be excluded from submitting Form 1099-PATR. Following are the general requirements that come under 1099-PATR filing instructions.

Who is Not Required to File Form 1099-PATR

The taxpayers are not required to file Form 1099-PATR for all the payments that are made to a corporation, which is a tax-exempt organization, which includes the tax-exempt trusts such as Archer MSAs, HSAs, and the Coverdell ESAs, operating in the United States, or the District of Columbia.

Statement to the Recipients

If the taxpayer is required to file Form 1099-PATR, they should furnish a statement to the recipient to avail more information about the requirement to furnish statements to the recipients.

Truncating the TIN of the Recipients on the Statements of the Payee

All the filers of the tax Form should truncate the payee SSN, individual TIN and EIN on the payee statements. Truncating is not allowed on any document that the taxpayer files with the IRS. The filer’s TIN shall not be truncated in any form.

2nd TIN Not

The taxpayer can enter a simple X in this box if they were notified by the IRS two times within the three calendar years that the payee has provided an incorrect TIN. If the taxpayer marks this box, then the IRS will not send any further notices pertaining to this account.

Instructions on Entering the Account Number

The account number is required to be entered if the taxpayer has multiple accounts for the recipient for whom they are filing more than one 1099-PATR form. Also, the IRS encourages taxpayers to designate a specific account number on all the tax Forms that they will file.

General Instructions on How to Fill out the IRS Form 1099-PATR

The following are the instructions for filing the different boxes in the 1099-PATR Tax Form.

Box 1: This box reports Patronage Dividends: Enter the patron’s share of the total patronage dividends that are paid in cash in this box.

Box 2: Nonpatronage distributions: This box is for entering the details pertaining to the Farmer’s co-operative that is exempt from tax under section 521. Enter the patron’s share of the total amount paid in cash, the qualified written notices of allocation, and other property on a patronage basis.

Box 3: Per-unit retail allocation: In this box, enter the patron’s share of the total per-unit retail allocations that are paid in cash, qualified per-unit retain certificates, and other property.

Box 4: Federal Income Tax Withheld: We have to enter backup withholding on patronage payments. Those who have not furnished their TIN are required to be subject to withholding on payments that are required to be reported on boxes 1,2,3, and 5.

Box 5: Redeemed Non-qualified notices: We have to enter the amount of the redeemed non-qualified written notices of all the allocations that were paid as a patronage dividend and the total amount of the redeemed nonqualified per-unit retail certificates that were paid as per unit retain allocation.

Box 6: Section 199A (g) deductions: For agricultural and horticultural cooperatives, insert the patron’s share of the section 199A(g) deduction claimed by the cooperative and passed through to them. The amount must have been designated in a written notice provided by the cooperative to the patron during the payment period under section 1382(d). Each patron’s deduction is limited to 9% of their eligible payments, as indicated in Box 7.

Box 7: Qualified Payments: Enter qualifying payments made to patrons of certain agricultural and horticultural cooperatives. You must give this information regardless of whether you pass the section 199A(g) deduction to patrons. See Section 199A(b)(7).

Box 8: Section 199 (A) qualified items: Enter amounts reported to patrons as qualified income, gain, deduction, or loss from non-SSTB trades or companies under section 199A. Qualified income excludes tax-exempt income, capital gains, and income not directly related to a trade or activity in the US. For more information on qualifying items, refer to the Instructions for Form 8995-A. Report SSTB-related items individually in Box 9.

Box 9: For Section 199A SSTB items: Enter amounts reported to patrons for qualifying items from SSTBs as per Section 199A. SSTBs provide services in various disciplines, such as health, legal, and accountancy. For further information on SSTBs and non-qualifying income, refer to Form 8995-A instructions.

Box 10: Reports the patron’s share of the total investment credit.

Box 11: This will report the total work opportunity credit.

Box 12: This will include other credits and deductions. This will include the empowerment zone employment credit, the low sulfur diesel fuel production credit, the credit for small employer health insurance premiums, credit for employer differential wage payments, etc.

Box 13: Specified Co-operatives: This box should be checked if the tax payer reports information pertaining to specified agricultural or horticultural co-operative.

The 1099-PATR tax Form corresponds to the Taxable Distributions that are received from the Co-operatives. The distributions that the taxpayer has received from a co-operative will be included in the income, and this has to be reported to the IRS through this tax Form.

E-File 1099-PATR Form Now with Tax2efile Today!