- February 5, 2025

Brokers generally send their customers Form 1099-B from the Internal Revenue Service for tax filing. This form itemizes all the transactions made during the tax year. Individuals use the information on the form to fill in the details in their Schedule D. Let us discuss the form and the instructions for filing it without errors in more detail here.

Table of Contents

What is IRS Form 1099-B?

For all the taxpayers out there who are not sure of what 1099-B is, it is an IRS tax Form that is used to report proceeds from Broker and Barter exchange transactions. The brokerage firms will generally use this IRS tax Form and the barter exchanges to record the gains and losses of a customer during the tax year. The individual taxpayer will receive their already filled out 1099-B Form from their brokers and barters.

Individual taxpayers will then transfer the information available on Form 1099-B to Form 8949 to calculate their preliminary gains and losses easily. They will enter the results on Schedule D of the tax Form.

Who Should File Form 1099-B

Brokers dealing with exchange transactions should submit a copy of the 1099-B Form to the IRS and also send a copy to each of its customers who sold stocks, commodities, options, and other securities during the tax year. The IRS mandates the submission of this tax Form as it serves as a record of the losses and gains of the taxpayer. These Forms are required to be sent to the investors by 15th February each year.

This tax Form should also be filed by the companies that participate in some form of bartering activities with others. For them, this Form will be used to report the changes in the capital structure or changes in the control of a corporation in which the taxpayer holds stock.

Things to Remember While Filing Form 1099-B

Having answered the question of what a 1099-B is, the next step is to answer how to file this tax form. A barter exchange or a brokerage should file a separate 1099-B form for every single transaction involved in a sale. This sale will include the short sales of commodities, stocks, foreign currency contracts, futures contracts, debt instruments, options, securities futures, etc.

It is important to read and understand 1099 B instructions thoroughly, before proceeding with filling and filing this tax Form. Generally, the following instructions need to be entered in the tax Form.

- Information related to the issuers

- Information pertaining to the taxpayer

- A brief description of each investment

- The purchase date and price of the stock

- Sale date and price

- The overall gain or loss of the financial transaction.

Generally, the commissions for all of these transactions will be excluded from the form. The 1099-B Form will report the cash received and the fair market value of the services and the goods received or the trade credits received. Taxpayers will be required to report the receipt of the gains that they have made during the bartering activity. The reportable gains can be in the form of cash, stock, or property.

A barter exchange broker should report every single transaction, other than the foreign currency, regulated futures, or options contracts, on separate 1099-B Forms. If a taxpayer receives Form 1099-B, they will be required to file Schedule D as well. This is where they will record their gains and losses for the tax year.

Specific Instructions Given by the IRS For Filing the 1099-B Form

A broker or barter exchange must file Form 1099-B for each individual:

- For whom the broker has sold (including short sales) equities, commodities, regulated futures contracts, foreign currency contracts (pursuant to a forward contract or regulated futures contract), forward contracts, debt instruments, options, securities futures contracts, etc., for cash.

- Who received cash, stock, or other property from a corporation that the broker knows, or has reason to know, had its stock acquired in an acquisition of control or had a significant change in capital structure reportable on Form 8806, Information Return for Acquisition of Control or Substantial Change in Capital Structure; or

- Who traded property or services in a barter exchange.

- Report sales of each of the following types of securities on a separate Form 1099-B, even if all three were sold in one transaction.

- Covered securities with a short-term profit or loss.

- Covered securities with long-term gains or losses.

- Noncovered securities (securities that are not covered securities) if you select option 5 when reporting their sale.

Qualified Opportunity Fund (QOF)

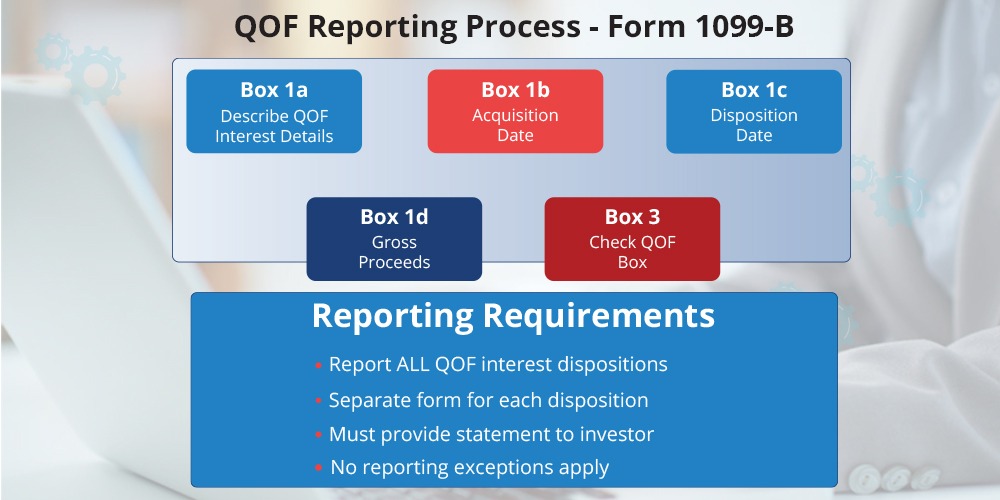

A QOF is a corporate or partnership-based investment entity. It is mandatory to report all QOF interests, regardless of who disposed of them. If the recipient is a corporation, you must still file Form 1099-B. The term disposition refers to any transfer of an investment, whether for consideration, gift, or inheritance.

Individuals should report each disposition on a separate Form 1099-B, regardless of how many they made in a calendar year. Dispositions of interests in a QOF are not subject to the reporting exceptions for brokers or barter exchanges. If you are a QOF that is not a broker or barter exchange and do not know if a broker or barter exchange has reported a disposition of an interest in the QOF, it is important to fill out the form as instructed for each item and box.

- Box 1(a): Fill out Box 1a to describe your QOF interests. For stocks, provide the number of shares or units, while for partnerships, enter the percentage investment.

- Box 1 (b): provide the acquisition date of any interest in the QOF.

- Box 1(c): indicate the date of disposition of any interest in the QOF.

- Box 1 (d): enter the gross cash proceeds from disposing of any QOF interests, if known.

- Box 3: Check the QOF box to report an interest in the QOF.

QOFs must provide a statement to the person who disposed of their investment interest. For more information on providing statements, refer to Part M of the general instructions. Brokers and barter exchanges should complete the 1099-B Form as usual for all dispositions of interests in the QOF. They should follow the specific instructions that are meant for brokers and barter exchanges, such as reporting the basis for a QOF investment or a covered security.

The most important 1099-B instructions are that you complete and fill in all the boxes as appropriate, depending on the nature of the interest disposed of, when filing the form.

How to File Form 1099-B for Digital Assets?

In 2025, brokers must complete Form 1099-DA, Digital Asset Proceeds Form for Broker Transactions, as per instructions. If you sold a digital asset that also qualifies as a security and requires Form 1099-B (dual classification asset), you should file Form 1099-DA instead. There are three exceptions to reporting the sale of a dual-classification asset on Form 1099-B or Form 1099-DA. Also, certain dispositions of the digital assets that are held by the WHFIT or the widely held fixed investment trust should be reported on Form 1099-DA.

How is Form 1099-B Used in the Tax Scenario?

The 1099-B tax Form will help taxpayers deal with capital gains and losses on their tax returns. Generally, when we sell something for more than the cost of purchasing it, the profit is considered a capital gain and is taxable. On the other hand, if we sell something for less than what we have paid, we have a capital loss. This form can be used to reduce taxable capital gains and other income.

Taxpayers will pay their capital gains taxes with their income tax return, with the help of Schedule D. The data given in the 1099-B Form will be of help to fill Schedule D and Form 8949, if required. Box 2 of the tax Form will indicate whether the gain or the loss involved is short-term or long-term. Generally, if the taxpayer has owned an asset, such as an equity, for a year or less before selling it, the gain or loss from the sale is considered to be short-term. On the other hand, if it has been owned for more than a year, then it is a long-term gain.

Some of the brokerage companies can also issue a composite 1099 Form that can replace multiple and individual 1099 Forms such as 1099-B Form, 1099-INT, 1099-DIV, etc. 1099-B Form is also used to report barter exchange transactions. They will use Box 13 of the form to report the fair market value of all goods and services that are received by an individual member of the exchange over a year.

Understanding the taxing secrets of trading units and barter exchanges can be overwhelming for the individual taxpayer. Let the tax expert from Tax2efile sort your unique tax situation and complete your taxes with 100% accuracy. The experts will uncover industry-specific deductions to help you enjoy more tax breaks and file your returns on time with the IRS.