- March 24, 2023

The IRS tax Form 1099-A is for filing the tax returns of the acquisition or abandonment of the secured property for each borrower if the taxpayer lends money in connection with their trade or business, in full or for partial satisfaction of the debt. It should also be filed if the taxpayer acquired an interest in the property, which is considered a security for the debt, or if the taxpayer has a reason to know that the property has been abandoned. Let us discuss this Form in detail and 1099-A instructions for filing with the IRS here.

What is Form 1099-A

Form 1099-A for the acquisition or abandonment of the secured property is a federal tax form that has to be filed by the lenders to report the properties that are transferred owing to foreclosure. The IRS requires the lenders to file the tax returns in the year following the calendar year, during which the taxpayer will acquire an interest in the property or when he first knows or has the reason to know, that the property has been abandoned. The issuers of the tax form should include details regarding the sale of the property, including the date of transfer of the property and the fair market value of the property.

Purpose of Filing IRS Form 1099-A

The primary purpose of filing the IRS Form 1099-A is to inform the IRS about the change in the ownership of the secured property, whether it has undergone foreclosure, abandonment, repossession, voluntary surrender, etc. This will help the IRS to track whether there will be a taxable loss or gain that the borrower should report on their tax return.

- Foreclosure: In the event of foreclosure of the property, the lender who has taken back the property as a means of settling the debt should file the IRS Form 1099-A to report the acquisition of the secured property.

- Repossession: In cases of repossession of the personal property that served as collateral for the loan, the lender should file Form 1099-A.

- Voluntary Surrender: if the borrower of the property voluntarily surrenders that property that serves as collateral for a loan, the lender should file Form 1099-A to report their acquisition of the property.

- Abandonment: When the borrower deems the property abandoned, and the lender becomes aware of this situation, the lender will be responsible for filing the IRS Form 1099-A to report its abandonment.

Who Should File Form 1099-A

The IRS Form 1009-A should be used by lenders such as banks and other financial institutions to notify the IRS when a property is transferred or sold because of foreclosure. The lenders are expected to submit the tax form the year after the calendar year during which someone acquires an interest in the property. The lender can file the tax Form if they know or believe that their property is abandoned.

There are generally three copies of Form 1099-A. The lender should file copy A with the IRS and send the owner to copy C. They will retain copy C. If one thinks that they should receive form 1099-A and have not sent one, they should contact the lender or the bank for the tax Form.

In short, the IRS Form 1099-A will be filed by the lenders who have lent the money against a property as security. This lender may be any one of the following, namely,

- Banks

- Credit unions

- Mortgage Company

- Government agency

- Private lenders

In case the borrower defaults, or if the property is deemed abandoned, then the lender should report this event to the IRS by making use of the IRS Form 1099-A. The lender is also required to send a copy of the tax Form to the borrower who has either lost or abandoned the property. This ensures that the borrowers are aware of the information reported to the IRS and can use it to fulfill their tax obligations, such as reporting the loss or gain of the property through its abandonment or acquisition.

Instructions for Filing IRS Form 1099-A

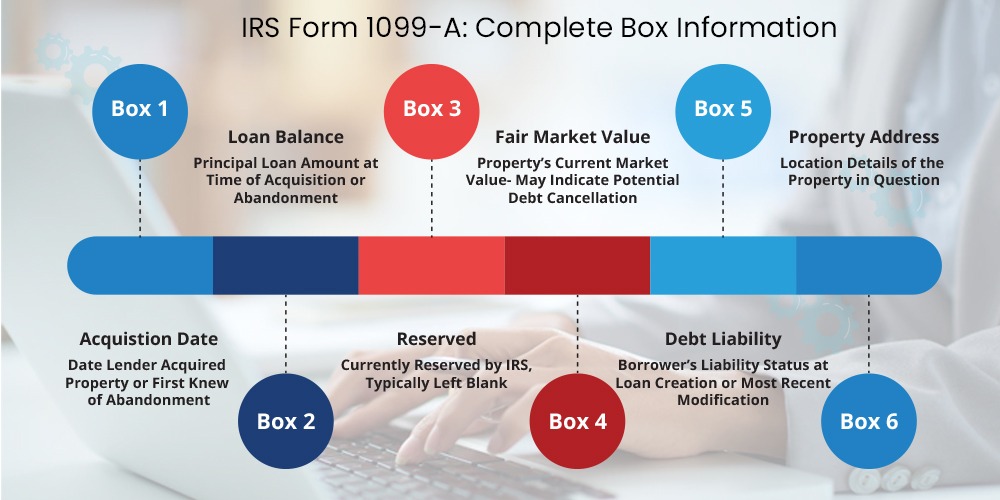

The left side of the tax Form will have all the details pertaining to the lender and the borrower and will include information such as the name, address, TIN, and the borrower’s account number. The right side of the tax Form will have the following details.

Box 1: This box includes the date of the lender’s acquisition or knowledge of abandonment. The box shows the date the lender acquired the property or the date when the lender first knew that the property was abandoned.

Box 2: This box shows the balance on the principal amount of the loan when the lender acquired the property. It will also include the date when the lender first knew that the property was abandoned.

Box 3: This box in the tax Form is reserved and is generally left blank.

Box 4: This box shows the fair market value of the property. If this amount in Box 4 is less than the amount given in Box 2 of the tax Form, the debt will be canceled, or the taxpayer may have cancellation of the debt income. In such case, they should receive IRS Form 1099-C.

Box 5: Box 5 of IRS Form 1099-A shows if the taxpayer was liable for the debt at the time it was created or modified, at the time of the most recent modification that was made in the tax Form.

Box 6: This box shows the address of the property. If this does not describe the product adequately, the lender will enter the section and also block the property.

How to File Form 1099-A

The following are 1099-A instructions to be followed by the taxpayer before filing this Form with the IRS. If a taxpayer has lost their home or any other real estate property owing to foreclosure, then they will receive a copy of Form 1099-A in the mail from the lender for their records. If they have more than one mortgage or loan for a single property, then they will receive multiple forms of 1099-A. These tax Forms will generally be sent by 31st of January each year.

This information of Form 1099-A can be used to report the foreclosure of the tax return. Taxpayers have to enter the information given on Schedule D of Form 1040, where they will report their capital gains and losses. In order to calculate the gain or loss, they will begin with the purchase price of the property and add the cost of all the major improvements. They will subtract the amount of all the allowable depreciation and other casualty and theft losses.

If the taxpayer is not liable for any debt that will remain on the loan, then they will not use the market value of the property. Instead, they will use all the outstanding mortgage balances at the time of foreclosure of the account. It has to be noted that the 1099-A is not the only form that will be required in connection with the abandonment or acquisition of the secured property. In some cases, it might be required to file Form 1099-C to report the cancellation of debt.

1099-A Instructions for Filing with the IRS

While filing the tax Form, it is important to follow these 1099-A instructions.

- It is important to describe the property. This will include the property’s location and identifying the property’s details.

- The date of abandonment or acquisition of the property should be indicated. This indicates when the property was taken back by the lender or left by the borrower officially.

- It is important to fill details of the balance of the principal outstanding. This figure represents the amount of the loan that remains unpaid at the time the property was acquired or abandoned.

- The fair market value of the property: This is the estimate of the value of the property at the time of property acquisition or abandonment. For tax purposes, this value is very crucial. It also plays a significant role in determining the potential gain or loss of the property.

- Contact information of the borrower: This will include the name and the tax identification number of the borrower.

Lenders should send a copy of the IRS 1099-A to the borrower and file another copy with the IRS. If a homeowner has lost a home due to foreclosure and has received Form 1099-A, then they need not file the Form themselves; this is the responsibility of the lender. However, they should report the information provided on Form 1099-A while filing their taxes. If a homeowner has more than one load or mortgage for a single property, then they will receive multiple 1099-A forms. These Forms are always sent by January 31st of each year.

Form 1099-A is a Federal tax form that lenders are required to submit to the IRS when they acquire property as a result of foreclosure or when the property is abandoned. One copy of the tax Form is sent to the IRS, the other copy is sent to the taxpayer to report on their annual tax returns and the lender will retain the final copy.